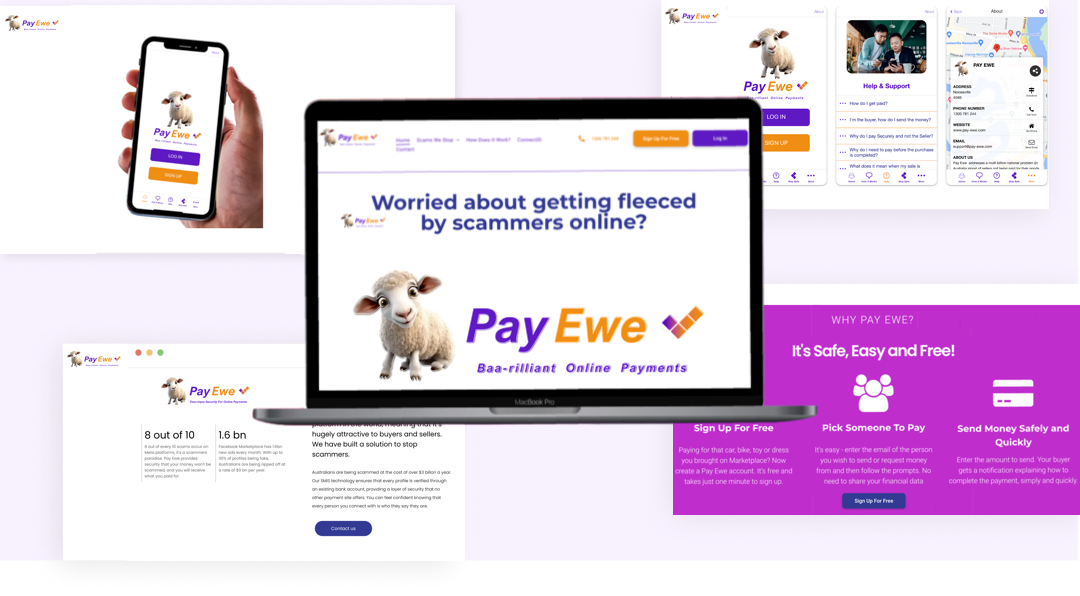

Building Trust in Peer-to-Peer Transactions: How We Created PayEwe Using NoCode Technology

Published on January 29, 2025

Written by Jaren Hidalgo · 9 minute read

Ensuring secure peer to peer payments is crucial in today’s digital world. From personal money transfers to high-value purchases, transaction security must be a priority. This article covers the best practices and technologies, including NoCode solutions, that make P2P payments safe. Discover how PayEwe tackles security challenges to provide a trustworthy payment platform.

What is PayEwe?

PayEwe is a user-friendly and secure peer-to-peer payment platform that makes long-distance transactions easy and safe. Embrace the convenience it offers for your online payments. PayEwe offers features like instant transactions and user verification to promote secure and efficient online payments.

PayEwe is a secure platform designed specifically for peer-to-peer payments, providing users with a safe method to conduct transactions over long distances.

Key Takeaways

PayEwe leverages NoCode technology to create a secure and efficient platform for peer-to-peer transactions, addressing critical security challenges in digital payments.

The integration of advanced security features, including an innovative escrow system and real-time transaction monitoring, ensures users can trust PayEwe for safe online payments.

With a scalable infrastructure and ongoing development, PayEwe is designed to adapt to the evolving needs of users while maintaining top-notch security and enhancing financial inclusion.

Overview

Trust and security are crucial in the evolving landscape of digital payments, particularly for peer-to-peer transactions. Our collaboration with PayEwe shows how NoCode technology can tackle these challenges, providing a robust and secure platform. We transformed an innovative concept into a trusted payment solution reshaping the Australian marketplace.

This post guides you through PayEwe’s journey from the initial challenge of securing peer-to-peer transactions to leveraging NoCode technology for rapid development. We delve into the key security features, the innovative escrow system, and the benefits of secure P2P payments.

We aim to provide a comprehensive understanding of how we created a secure, scalable platform using NoCode technology.

The Challenge: Securing Peer-to-Peer Transactions

When PayEwe approached us with their vision of creating a secure payment platform for long-distance transactions, the challenge was clear: develop a solution that could effectively combat the rising threat of scams and fraud in peer-to-peer payments. With Australians frequently engaging in long-distance transactions for high-value items like cars, furniture, and electronics, the need for a secure escrow-based payment system was evident.

The main concern was securing payment processing and protecting users from fraudulent transactions. Online payment security is a critical aspect of any payment platform, and we needed to implement a robust payment security strategy to address these challenges. This required understanding and integrating various secure payment methods into the platform, including a secure payment method.

We focused on developing a network security firewall framework to identify and prevent fraudulent transactions. This included strong customer authentication, asymmetric encryption, and monitoring transaction patterns to detect suspicious activities. Our goal was to create a secure sockets layer connection and transport layer security for all financial transactions, ensuring users could trust the platform for high-value purchases.

Understanding Secure Peer-to-Peer Payments

Peer-to-peer (P2P) payment systems enable quick money transfers between individuals using digital channels, linking bank accounts or cards. The rise of P2P payments has prompted traditional banks to enhance their digital services to remain competitive, but it also brings new challenges in terms of online payment security and the protection of customer payment data.

Regulatory frameworks are being established worldwide to ensure consumer protection and integrity within P2P payment systems. These regulations aim to standardize secure payment methods and prevent potentially fraudulent transactions. Understanding these frameworks, SSL, and payment processors is crucial for developing a secure P2P payment platform.

Leveraging NoCode Technology for Rapid, Secure Development

Our development team chose Bubble, a powerful NoCode platform, to bring PayEwe’s vision to life. This strategic choice allowed us to focus on building robust security features while maintaining rapid development cycles. The platform’s flexibility enabled us to create a sophisticated payment solution without compromising on security or user experience.

Using Bubble, we implemented a secure system with strong customer authentication and access controls. The NoCode technology allowed us to rapidly prototype and iterate on features, ensuring each component met the highest security standards. This approach sped up development and ensured quick adaptation to emerging security challenges.

Key Security Features Implemented

Using our NoCode development expertise, we implemented comprehensive security measures to protect customer data and ensure secure payment processing. One key feature was the advanced escrow system, which securely holds funds until both parties are satisfied with the transaction. This system prevents fraudulent transactions and ensures peace of mind for both buyers and sellers.

We integrated Connect ID for robust user verification, preventing fraud by ensuring only verified users access the platform. This multi-layer security approach includes bank verification and real-time transaction monitoring to oversee payment flows and detect any potentially fraudulent activities. The secure user interface we developed is both intuitive and packed with built-in security features to enhance the overall user experience.

Other security measures included two-factor authentication, role-based access control, and secure storage of sensitive data. By implementing these features, we ensured that PayEwe is equipped to handle secure payments and protect users from any security breach.

Innovative Escrow Systems for Peer-to-Peer Payments

Escrow systems act as trustworthy intermediaries in peer-to-peer transactions, ensuring escrow payments are only released when agreed-upon conditions are met. This mechanism is particularly effective in preventing fraud by ensuring that the seller receives payment only after the buyer confirms satisfactory receipt of goods or services. For high-value long-distance transactions, such as those common in Australia, this system is invaluable.

NoCode technology enabled the rapid development of this secure escrow system. By leveraging Bubble’s capabilities, we created an escrow-based payment platform that provides secure transaction solutions for fintech companies. This approach ensures users can engage in online transactions confidently, knowing their funds are secure until the transaction is completed.

The escrow system is seamlessly integrated with PayEwe’s payment processor and gateways, ensuring a smooth and secure user experience. This integration allows for secure payment processing and the prevention of potentially fraudulent transactions, making the platform reliable and trustworthy for all users.

Development Process and Implementation

Our approach to building PayEwe focused on balancing security with usability. We started with a basic template in Bubble and customized the core functionality to match PayEwe’s requirements. We implemented extensive security measures and verification systems, ensuring that the platform could handle secure payments effectively.

The development process included creating an intuitive user interface for buyers and sellers and integrating Connect ID for enhanced user verification. We developed a scalable infrastructure to support growing transaction volumes, ensuring PayEwe could evolve and scale with user demand.

Bubble’s NoCode capabilities enabled rapid prototyping and iteration, ensuring each component met high security standards while remaining user-friendly.

Benefits of Secure Peer-to-Peer Payments

Secure peer-to-peer payments offer numerous benefits, including enhanced financial inclusion and reduced risk of fraud. By accessing underserved populations, P2P payment services promote financial inclusion and trust among users. This is particularly important in a fragmented global payments landscape, where building and maintaining a circle of trust is vital for payment platforms to ensure user loyalty.

Data breaches can destroy customer trust, making it crucial for payment platforms to implement robust security measures. In fact, 66 percent of U.S. consumers wouldn’t trust a brand after a data breach. Prioritizing online payment security and implementing secure methods helps businesses build trust and foster long-term loyalty.

Additionally, secure P2P payment platforms like PayEwe provide a safe and reliable payment experience, which is essential for maintaining regulatory compliance and protecting sensitive payment information. Preventing fraudulent transactions and following stringent protocols ensures the safety and security of online payments.

Results and Impact

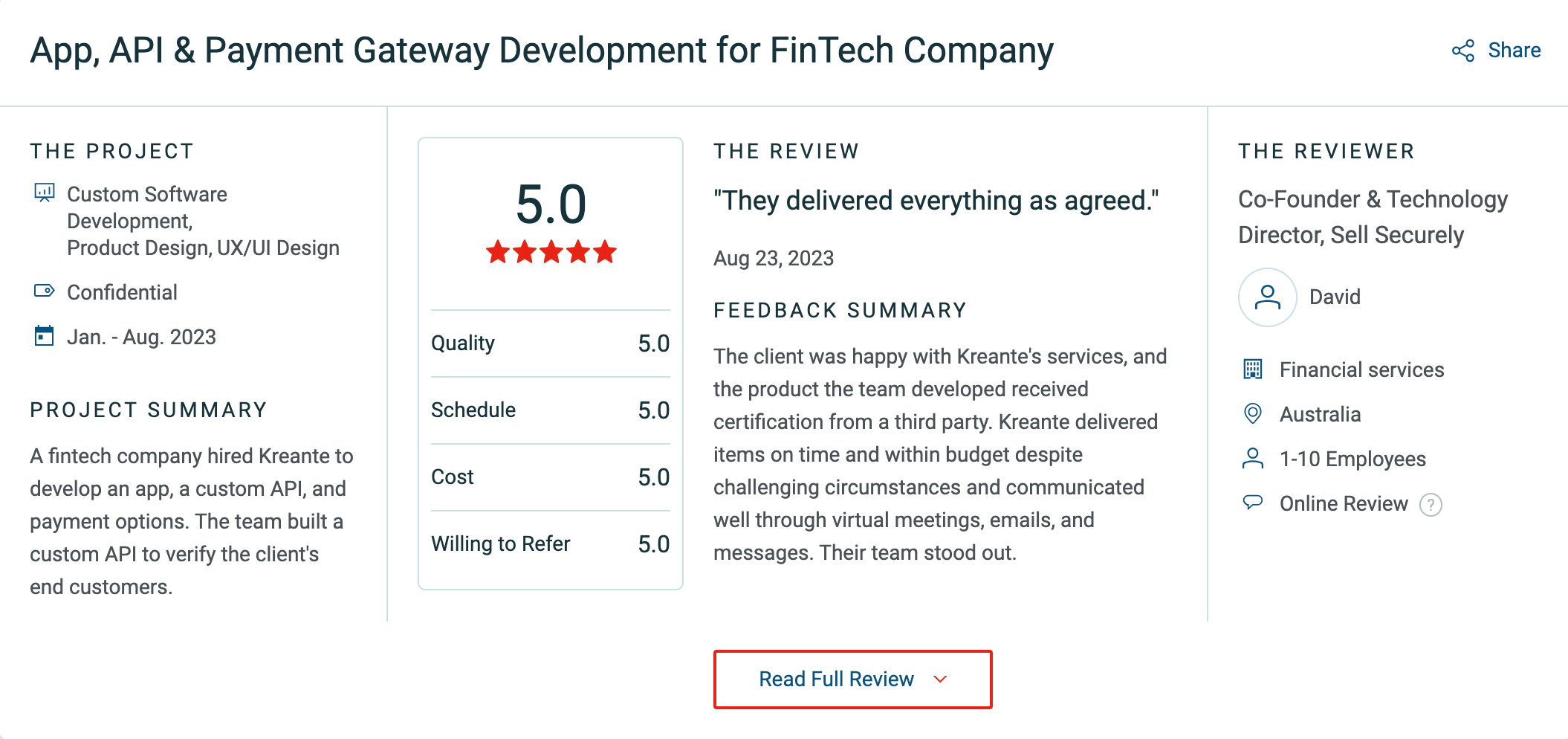

PayEwe’s launch demonstrated the power of NoCode development in creating secure fintech solutions. Completed in just three months, the platform has achieved significant milestones, including rapid market entry and enhanced transaction security. The multi-layer security protocols significantly reduced fraud risk, providing users with a secure and reliable platform.

User adoption has been strong, with early users highlighting the platform’s ease of use and security features. PayEwe has received industry recognition, including multiple award nominations in the fintech space.

The scalable infrastructure ensures PayEwe is ready for growing transaction volumes, demonstrating the platform’s long-term viability.

The Role of NoCode Technology in Payment Security

NoCode technology streamlines the creation of secure P2P payment applications. Platforms like Bubble allow developers to rapidly customize security features to meet specific user needs without extensive programming skills. This flexibility is crucial for implementing complex security protocols and ensuring secure payment processing.

Kreante’s work with PayEwe shows how NoCode tools effectively enhance payment security in the fintech sector. Leveraging NoCode technology, we rapidly developed a secure payment platform that meets users’ evolving needs, protecting customer data and preventing fraud.

Innovation in NoCode Security Solutions

Our work with PayEwe signifies a significant advancement in what’s possible with NoCode tools in the fintech sector. Leveraging Bubble’s capabilities, we’ve proven that NoCode solutions can deliver enterprise-grade security features while maintaining excellent usability.

This innovation in NoCode security includes advanced fraud detection, secure storage, and strong access controls. These features are essential for preventing data breaches and ensuring the safety of users’ sensitive information.

By continuously innovating and adapting to security challenges, we ensure PayEwe remains a secure and reliable platform.

Real-Time Transaction Monitoring

With the rise of digital payments, managing risk becomes more complex, necessitating scalable solutions that adapt to evolving security challenges. PayEwe includes real-time transaction monitoring to oversee payment flows and detect and prevent fraudulent activities. This capability is crucial for identifying suspicious transactions and preventing fraud.

PayEwe’s real-time monitoring system uses advanced fraud detection tools to analyze transaction patterns and identify anomalies. This proactive approach ensures users can trust the platform, knowing any suspicious activity will be promptly addressed.

Future-Ready Platform

The NoCode architecture ensures PayEwe can continue to evolve and scale. Bubble’s robust infrastructure provides a solid foundation for future feature additions and security enhancements, demonstrating the long-term viability of NoCode solutions for fintech applications.

This platform adapts to the ever-changing digital payment landscape, ensuring PayEwe remains at the forefront of secure P2P payments.

User Verification Through Connect ID

User verification prevents unauthorized access and ensures secure transactions in P2P payments. PayEwe integrated Connect ID for robust user verification to prevent fraud. This integration ensures only verified users access the platform, adding an extra layer of security.

Connect ID uses biometric and multi-factor authentication to verify user identity, ensuring a secure connection for all transactions.

Centralizing ID verification with payment operations streamlines integration and reduces operational overhead for businesses, ensuring a seamless experience for legitimate users while preventing fraud.

Scalability and Future Evolution

The P2P payment market is projected to grow significantly, indicating increasing consumer trust and reliance on these platforms. PayEwe’s scalable infrastructure supports growing transaction volumes, ensuring it can handle increased user demand without compromising security or performance.

PayEwe’s NoCode architecture ensures future evolution and scalability, allowing the platform to adapt to emerging market needs and technological advancements.

Ongoing Partnership

Our collaboration with PayEwe continues beyond the initial launch. We maintain a close partnership, providing ongoing support and implementing new features as the platform grows. This ongoing relationship ensures PayEwe remains at the forefront of secure P2P payment solutions, adapting to emerging security challenges and user needs. By continuously innovating and improving the platform, Kreante ensures PayEwe offers the best possible experience to its users.

Looking to create a secure, scalable platform for your fintech vision? Contact us for a free call and visit our blog to learn how our NoCode expertise can bring your project to life while maintaining the highest standards of security and user experience. Please read our full Clutch review here.

Conclusion

In conclusion, payment security is a vital aspect of online payments that demands attention from both businesses and consumers. By understanding the importance of payment security and implementing robust measures to protect customer data, businesses can build trust with their customers, maintain regulatory compliance, and prevent costly data breaches. In Australia, where online shopping and digital payments are increasingly prevalent, the significance of payment security cannot be overstated. By prioritizing payment security, businesses can ensure a safe and secure online payment experience for their customers, protecting sensitive customer information and fostering long-term customer loyalty.

The security measures in digital payment systems are crucial for protecting financial data and ensuring privacy. Encryption, authentication methods such as biometrics and two-factor authentication, and tokenization are essential for safeguarding sensitive information during digital transactions.

By staying informed and practicing safe online behaviors, users can protect their financial data and enjoy secure online payment methods.

Summary

In summary, building trust in peer-to-peer transactions requires more than just innovative technology; it demands a commitment to robust security measures. PayEwe, developed using NoCode technology, exemplifies how a secure, user-friendly platform can be rapidly created to meet the evolving needs of the digital payment landscape, such as, effectively address the challenges of securing P2P payments. From advanced escrow systems to real-time transaction monitoring and user verification, each security feature of PayEwe is designed to ensure a safe and seamless transaction experience.

As we look to the future, the importance of secure peer-to-peer payments will only grow. By leveraging NoCode technology, businesses can rapidly develop secure payment solutions that meet the evolving needs of users while building trust with their customers and foster long-term loyalty

Platforms like PayEwe are leading the way, demonstrating that with the right approach, secure and efficient P2P payments are not just possible—they are the future. Embrace this future, and let PayEwe be your trusted partner in secure peer-to-peer transactions, and Kreante your partner in transforming your fintech vision into a reality.